Gain the Competitive Edge with Advanced Technology for Integration, Decisioning, KYC and Operationalized Risk Models

Companies that can offer clients simple, efficient factoring and invoice discounting services are the ones that will win more business. But these companies can’t do so at the risk of failing to meet KYC regulations or taking on high-risk clients.

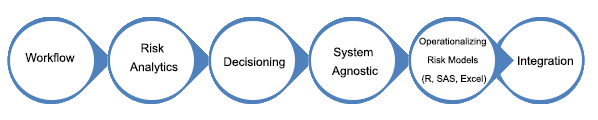

Provenir delivers a unified, vendor-agnostic platform to help your business make the right decisions and make them faster. Leveraging workflow automation, easy integration capabilities and real-time risk analytics and decisioning, Provenir can help you automate and streamline factoring and invoice discounting from start to finish. Instead of days or weeks to complete the process, you can make a decision in just a few minutes to accelerate market growth while reducing risk and ensuring compliance.

- Cut time and costs with end-to-end workflow orchestration and configurable integration adapters that automatically aggregate information from virtually any internal and external data source.

- Increase compliance with automated KYC processes that gather data from multiple systems and bureaus, standardize and analyze it to drive a decision.

- Lower risk with industry-standard financial risk models, including R, SAS, Excel and PMML, easily operationalized within automated risk decisioning processes.

- Increase business-level control and agility with visual configuration tools to quickly create and change user interfaces, rules, processes and integrations without any programming or dependence on Provenir.

- Accelerate deployment with the Provenir Cloud which offers a highly secure cloud environment with flexible options for domain setup, managed services, deployments and scalability.

Provenir simplifies, automates and streamlines complex factoring and invoice discounting processes to deliver a better client experience, increase efficiency, ensure compliance and reduce risk.

Simplify Integration and Decisioning Processes

- Pre-built adapters automate data aggregation with quick integration to multiple sources including enterprise and third-party systems, websites, credit bureaus and social media.

- Workflow orchestration can automatically manage data enrichment, use existing analytic models to determine risk and move to the next step in the process.

- Straight-through processing supports instant decisioning with no manual intervention where appropriate.

- Fully-featured document management provides a centralized, enterprise-wide repository that acts as a single source of information for all decisioning and business processes.

- Customized documents delivered by the latest technology create a socially collaborative customer experience.

Cut Time and Costs for KYC Compliance

- Integrated KYC/AML workflow automatically identifies, verifies and validates a client.

- Dynamic business logic can determine compliance or non-compliance and refer an application to the right individual for further analysis.

- Business-defined rules support specialization, applying the right regulations and ensuring the right data is captured for each client.

Improve Underwriting Efficiency

- Easy-to-use- model integration adapters allow any risk model or scorecard developed in industry-standard tools, including SAS, R, Excel, or exported using PMML/MathML, to be quickly operationalized in decisioning processes.

- Rules-driven decisioning applies risk models and scorecards to aggregated data to automatically determine a rating.

- A visual interface simplifies risk rating on an on-going basis, such as viewing previous or historical ratings, modifying ratings and re-rating.

Learn how easy it really is to operationalize risk models with Provenir.

Increase Business Agility

- Wizards make it easy to import, validate and map simple and complex risk models and scorecards without any programming.

- A visual configuration environment provides graphical tools and wizards to rapidly integrate with data sources, develop interfaces, define rules and build workflows.

- Visual testing capabilities include champion/challenger testing to facilitate “what if” analysis before risk decisioning processes are put into production.