Navigating South Africa’s Debt Crisis: Strategies for Recovery and Engagement in 2025

Navigating South Africa’s Debt Crisis: Strategies for Recovery and Engagement in 2025

- September 17th 2025

- The Maslow, Johannesburg

As the South African debt landscape grows increasingly complex, financial institutions face the critical challenge of balancing effective debt management with an exceptional customer experience. This exclusive roundtable brings together senior decision-makers from across the industry to explore innovative strategies for mitigating consumer over-indebtedness, while enhancing financial inclusion and long-term engagement.

With a focus on the country’s most affected groups—particularly Millennials and Gen Z—this session will delve into the evolving credit behaviours, emerging risks, and tactical responses required in 2025. Participants will gain actionable insights into transforming collections, personalising recovery journeys, and leveraging fintech to drive both profitability and customer well-being.

Key Discussion Points:

- Managing and Mitigating the Growing Debt Bubble: Understanding how inflation, high interest rates, and unsecured lending are fueling over-indebtedness—and what strategies financial institutions can use to respond.

- Delivering a Gen Z and Millennial Customer Experience: Meeting the expectations of younger generations facing income instability, low financial literacy, and digital-first credit behaviours—while fostering engagement and trust.

- Achieving the Seemingly Impossible: Exploring how fintech innovation, personalised recovery journeys, and empathetic engagement can reduce operational costs while improving repayment outcomes.

7:45 am

Arrival and Welcome Drink8:00 am

Keynote: Inside the 2025 South African Credit Crisis: What the Data Reveals – Tej Desai, CEO Collections and Recoveries, ALEFBET HOLDINGS8:30 am

Roundtable Discussion and breakfast11:00 am

Official Close and Summary

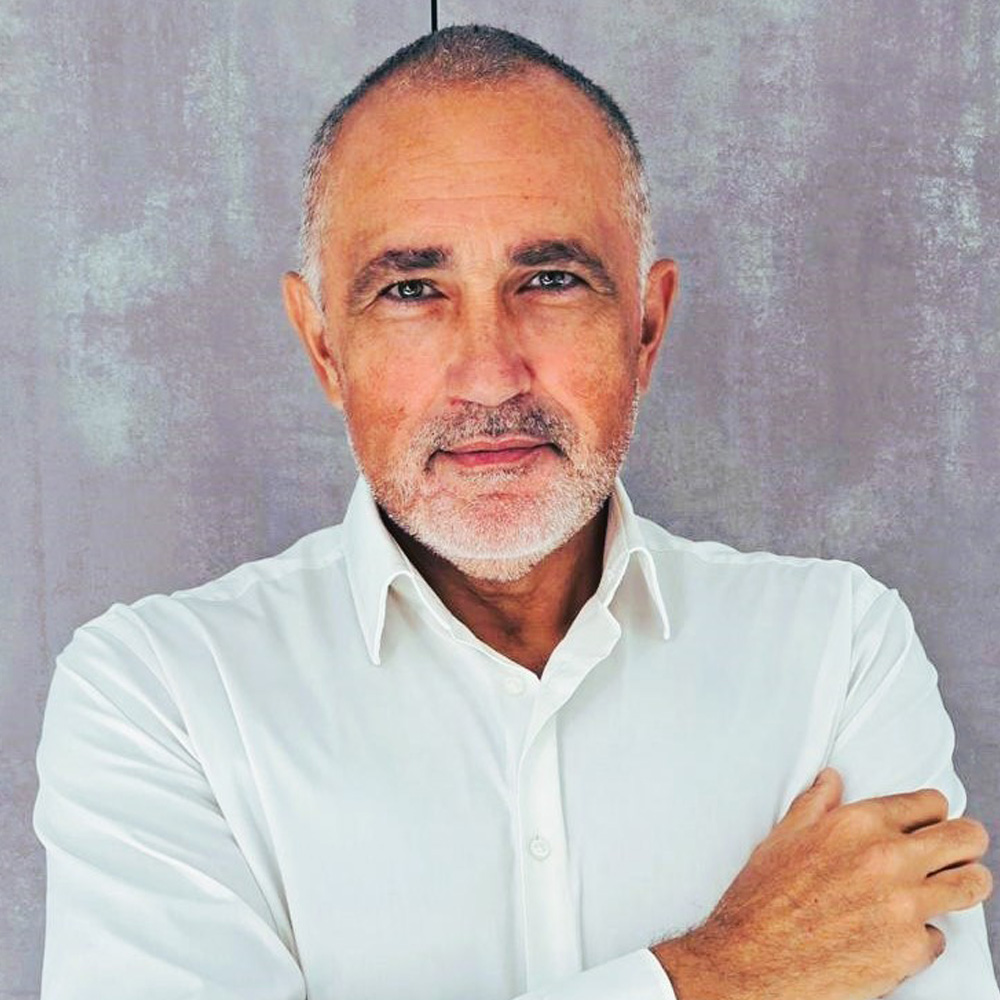

Tej Desai

CEO Collections and Recoveries, ALEFBET Holdings

Tej is a seasoned executive and passionate advocate for business-led digital transformation. With a sharp instinct for connecting data, digital innovation, and human-centered change, he’s led organizations through complex transformations that create real, lasting impact. Known for his ability to align people, technology, processes, and risk, Tej thrives on turning strategic vision into meaningful action. He leads with clarity, empathy, and purpose—ensuring that change isn’t just managed, but embraced.

Beyond the boardroom, Tej is deeply committed to mentoring the next generation of leaders. Through this dual commitment to innovation and empowerment, Tej is helping shape a future where technology and transformation go hand in hand—building a better tomorrow for businesses and society alike.”