Streamlined Application

Fraud and Identity Management

Reduce friction and prevent fraud losses, with dynamic data orchestration,

automated AI decisioning, and integrated investigation handling.

60%

improvement in

decisioning efficiency

decisioning efficiency

Deliver frictionless customer experiences – without sacrificing your fraud detection power. Automate your fraud and identity data integration and orchestration, streamline your decisioning, and enable seamless case management for the confidence to say yes more and drive business growth.

135%

of high-risk transactions stopped

40%

business growth

Deliver frictionless customer experiences – without sacrificing your fraud detection power. Automate your fraud and identity data integration and orchestration, streamline your decisioning, and enable seamless case management for the confidence to say yes more and drive business growth.

60%

improvement in decisioning efficiency

135%

of high-risk transactions stopped

40%

business growth

Trusted fraud and identity solutions with proven business benefits:

Deliver frictionless customer experiences to reduce abandonment and improve customer satisfaction.

- Reduce False Positives

Use a layered approach to reduce false positive rates and quickly differentiate genuine customers from fraudsters, minimizing interruptions during the onboarding experience. - Accelerate Identity Verification

Leverage automated identity verification to support real-time decision-making for rapid customer and merchant onboarding. - Streamline Investigations

Enable frictionless customer experiences with integrated case management for rapid investigations into intent to pay. - Automate Approvals

Fully automate fraud and identity processes to support real-time approvals and gain a competitive advantage.

Turn “must-do” fraud processes into a growth enabler with the combined power of dynamic data orchestration and intelligent automation for smarter decisioning.

- Minimize Losses

Improve fraud detection with decisions based on multiple layers of fraud detection capability and control how and when multiple layers are used. - Maximize Growth

Attract and retain more satisfied customers, directly contributing to business expansion, by ensuring a secure and efficient onboarding process. - Accelerate Approvals

Streamline customer verification with rapid, real-time fraud detection for faster service delivery and improved satisfaction. - Enhance Efficiency

Leverage automation to reduce manual fraud checks, allowing for more strategic allocation of resources towards growth initiatives.

Take control of your fraud strategy with a low-code, end-to-end AI decisioning platform that brings together data, decisioning, and case management into one solution.

- Sustain Detection Power

Ensure continuous improvement in fraud, identity and compliance risk models with AI model creation, monitoring, testing, and optimization. - Simplify Fraud Management

Reduce the complexity of managing multiple fraud tools with one solution to power an end-to-end view of the customer across the lifecycle. - Adapt Easily

Rapidly respond as new threats emerge with easily configurable rules. - Test With Ease

Easily assess changes for iteration with Champion/Challenger testing of your fraud risk models. - Innovate with Confidence

Trust your fraud processes to manage risk as you explore new opportunities to drive growth across your product portfolio.

Minimize Friction for Streamlined Onboarding

Deliver frictionless customer experiences to reduce abandonment and improve customer satisfaction.

- Reduce False Positives:

Use a layered approach to reduce false positive rates and quickly differentiate genuine customers from fraudsters, minimizing interruptions during the onboarding experience. - Accelerate Identity Verification:

Leverage automated identity verification to support real-time decision-making for rapid customer and merchant onboarding. - Streamline Investigations:

Enable frictionless customer experiences with integrated case management for rapid investigations into intent to pay. - Automate Approvals:

Fully automate fraud and identity processes to support real-time approvals and gain a competitive advantage.

Reduce Losses, Optimize Growth

Turn “must-do” fraud processes into a growth enabler with the combined power of dynamic data orchestration and intelligent automation for smarter decisioning.

- Minimize Losses:

Improve fraud detection with decisions based on multiple layers of fraud detection capability and control how and when multiple layers are used. - Maximize Growth:

Attract and retain more satisfied customers, directly contributing to business expansion, by ensuring a secure and efficient onboarding process. - Accelerate Approvals:

Streamline customer verification with rapid, real-time fraud detection for faster service delivery and improved satisfaction. - Enhance Efficiency:

Leverage automation to reduce manual fraud checks, allowing for more strategic allocation of resources towards growth initiatives.

Smarter Detection, Greater Agility

Take control of your fraud strategy with a low-code, end-to-end decisioning platform that brings together data, decisioning, and case management into one solution.

- Sustain Detection Power:

Ensure continuous improvement in fraud, identity and compliance risk models with AI model creation, monitoring, testing, and optimization. - Simplify Fraud Management:

Reduce the complexity of managing multiple fraud tools with one solution to power an end-to-end view of the customer across the lifecycle. - Adapt Easily:

Rapidly respond as new threats emerge with easily configurable rules. - Test With Ease:

Easily assess changes for iteration with Champion/Challenger testing of your fraud risk models. - Innovate with Confidence:

Trust your fraud processes to manage risk as you explore new opportunities to drive growth across your product portfolio.

How can we optimize your

fraud & identity strategy?

How can we optimize your fraud and identity strategy?

Discover who we work with and how we’re used.

FRAUD AND IDENTITY RESOURCE LIBRARY

NEWS: 2025 New Globa...

New Global Survey Shows Nearly Half of Financial Services Executives Struggling to Manage Credit Risk ...

NEWS: Financial Serv...

Financial Services Trends for 2025 Fraud Prevention, Customer Account Management, and More Financial institutions will ...

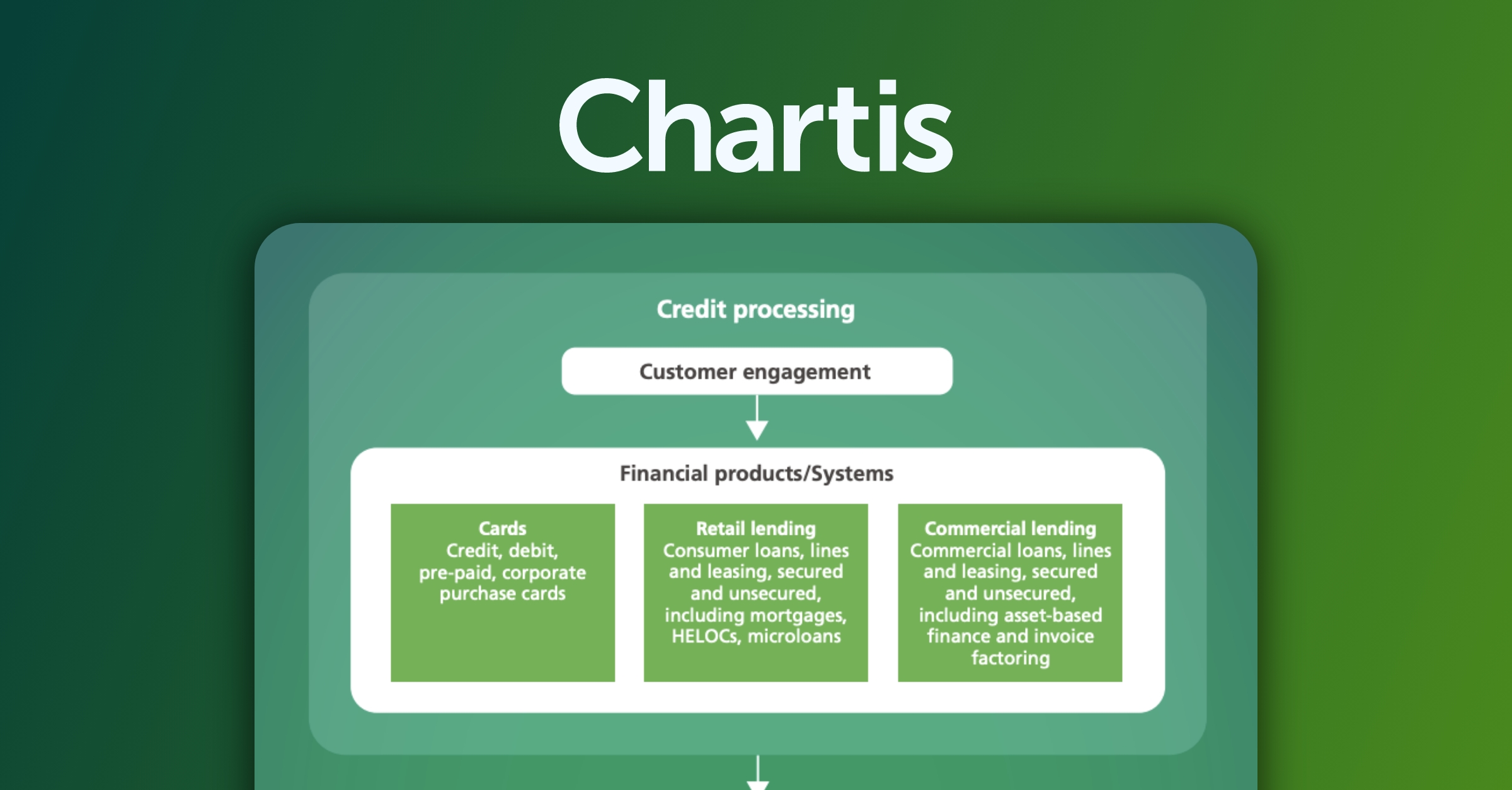

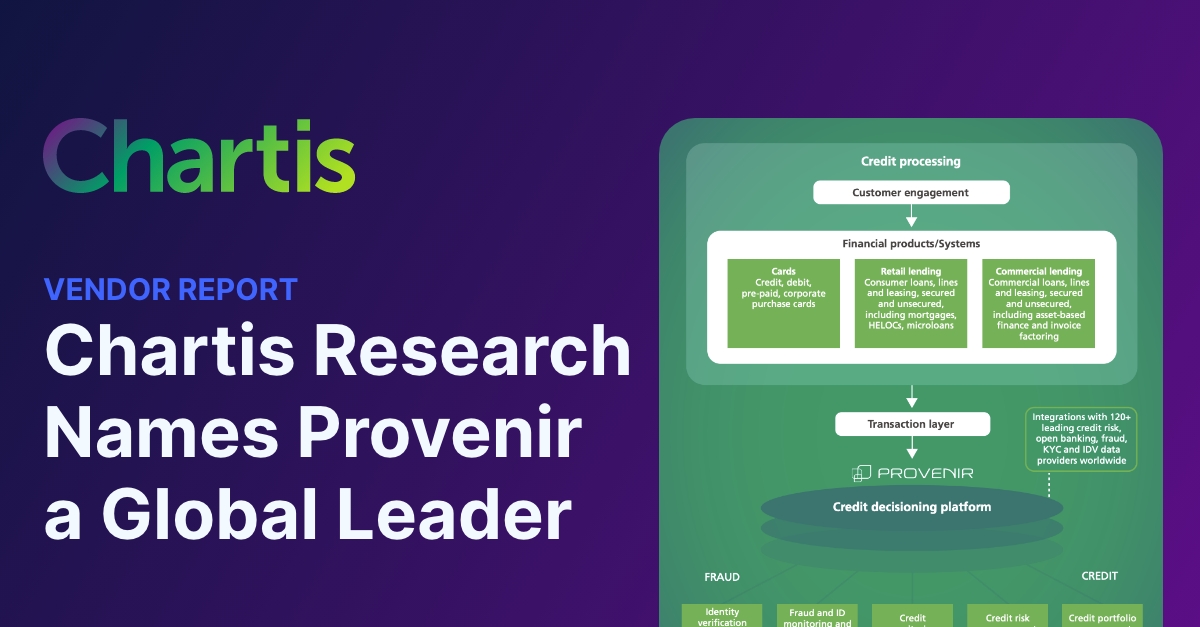

News: Chartis Resear...

Chartis Research Executive Brief Details Provenir ‘Best-in-Class’ Capabilities for Credit Risk and Fraud Mitigation With ...

Vendor Report: Chart...

Chartis Research Names Provenir a Global Leader Credit and Fraud – A Holistic View in ...