Lending Affordability and Regulations in the Nordics: Navigating Rising Debt and Consumer Protection

Lending Affordability and Regulations in the Nordics: Navigating Rising Debt and Consumer Protection

The Nordic countries—Denmark, Finland, Iceland, Norway, and Sweden—have long been celebrated for their stable economies, strong social safety nets, and sound financial systems. However, rising household debt and escalating housing costs are placing increasing pressure on lending affordability, prompting regulators to implement stricter controls to ensure responsible borrowing and protect financial stability. Adding to these challenges, global economic factors such as inflation, interest rate hikes, and geopolitical tensions are significantly impacting the Nordic lending market.

As a result, Nordic borrowers are finding it increasingly difficult to manage their debt and maintain affordability. Household debt has surged across the Nordics, especially in Sweden, where the debt-to-income ratio has surpassed 150%. Many consumers are now struggling with higher mortgage payments, causing regulators to step in.

Nordic governments are increasingly imposing restrictions on consumer loans to protect borrowers from predatory lending and unmanageable debt, in addition to tightening mortgage regulations. Finland, for example, has capped interest rates on consumer loans at 20%, while similar actions are being implemented across the region to address high-interest lending. Each country is tackling lending affordability with distinct measures. Sweden, for instance, emphasizes amortization requirements to reduce debt levels over time, while Denmark focuses on income-based lending caps to ensure that borrowers do not take on more debt than they can afford. These country-specific approaches highlight the region’s nuanced strategies for maintaining financial stability and protecting consumers in a challenging economic environment.

Looking ahead, stricter regulations could reshape the financial services landscape in the Nordics, potentially slowing growth for lenders while encouraging more sustainable lending practices. Lessons from past regulatory cycles in other regions, such as tighter controls in the U.S. and Europe following financial crises, suggest that while short-term growth may be impacted, long-term stability and consumer trust could improve, setting the stage for a more resilient financial sector.

But, thankfully, the rapid advancement of technology is reshaping the financial services landscape in the Nordic region, where digital lending platforms, open banking, and fintech innovations are driving significant changes in how consumers access credit. While these technologies offer unparalleled convenience and inclusivity, they also introduce complexities related to lending affordability. Are these innovations making it easier for consumers to secure loans, or are they exacerbating the issue of rising debt?

Digital lending platforms and fintech solutions have made borrowing more accessible than ever. In the Nordics, where internet penetration is among the highest in the world, consumers can now apply for and receive loans entirely online, often within minutes. These platforms leverage open banking frameworks to access a wider range of financial data, allowing lenders to make more informed decisions about creditworthiness. This streamlined approach has expanded access to credit, particularly for underserved populations who may have struggled to secure loans through traditional banks.

However, this ease of access presents a double-edged sword. While consumers certainly benefit from the convenience, there’s also a risk of over-borrowing, as the simplicity of digital lending can sometimes lead to impulsive financial decisions. The seamless user experience offered by many fintech platforms can obscure the long-term financial implications of taking on more debt. For lenders, this raises the question of how to balance innovation with responsibility. Regulatory bodies in the Nordics need to closely monitor these developments to ensure that technological advancements don’t compromise financial stability.

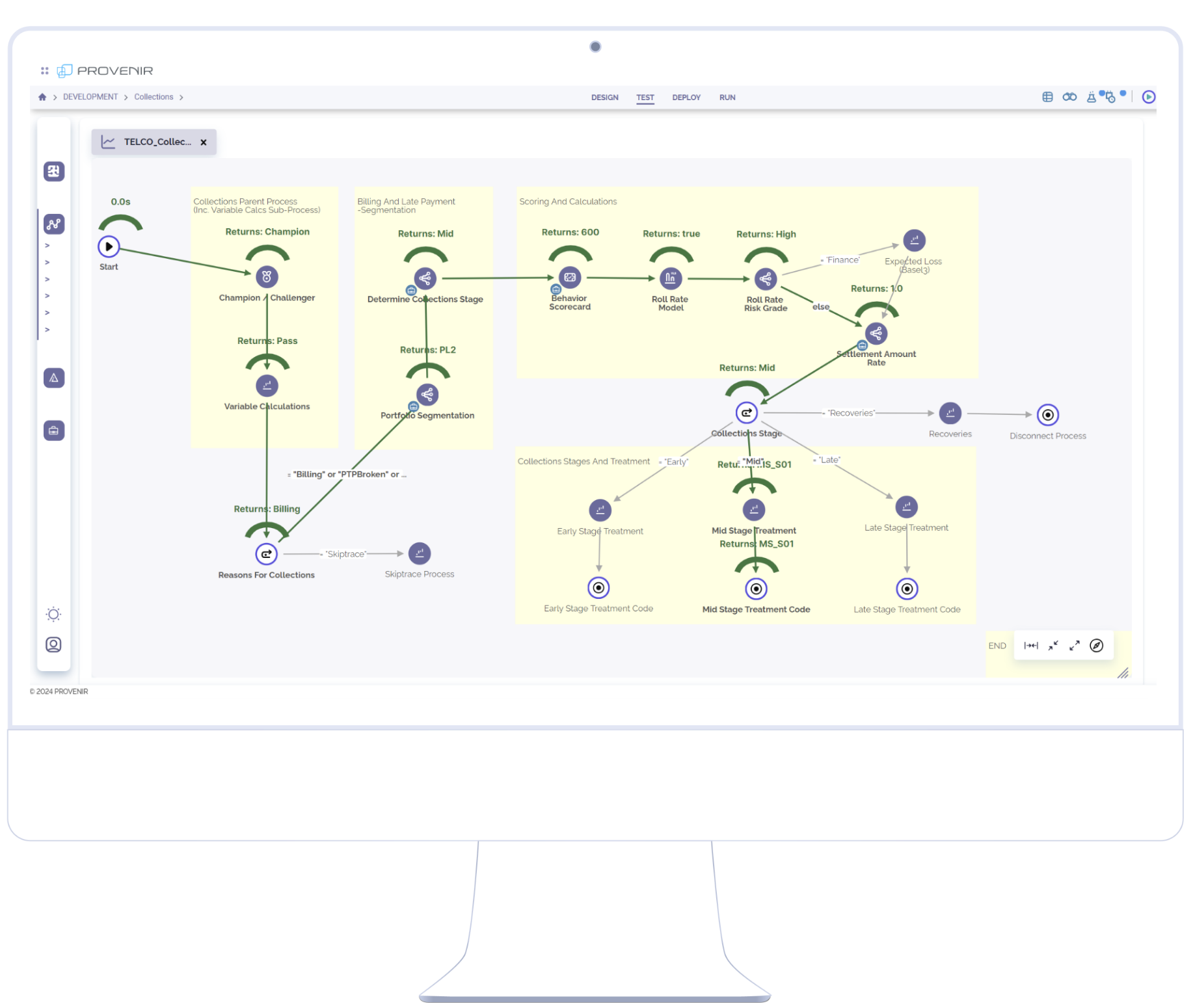

Artificial intelligence (AI) is playing an increasingly pivotal role in refining affordability assessments. By analyzing vast amounts of data—from spending patterns to employment history—AI-driven tools offer a more holistic view of a borrower’s financial health than more traditional credit scoring methods. These tools can detect nuances that human analysts or outdated systems might miss, ensuring that lending decisions are based on a comprehensive and real-time understanding of a borrower’s ability to repay.

For lenders, AI offers the dual benefits of improving accuracy and reducing risk. By predicting a consumer’s likelihood of default with greater precision, AI-driven affordability assessments allow lenders to adjust their loan offerings accordingly. This means that consumers are less likely to be approved for loans they can’t afford, mitigating the risk of rising debt levels. Additionally, AI-powered automation helps lenders streamline their operations, reducing the time and cost associated with manual assessments.

In the Nordic region, where regulators are tightening lending criteria, AI is becoming an essential tool for compliance. Lenders can integrate AI into their decision-making processes to ensure they meet strict affordability guidelines while continuing to provide accessible credit to consumers. The use of AI also helps reduce bias in lending decisions, as algorithms are trained to assess objective financial indicators rather than relying on potentially flawed human judgment.

Danske Bank is one successful example. They’ve integrated digitalization and advanced data analytics into their lending process, which has helped the institution manage affordability risks more effectively. The bank’s “Sunday” mobile app uses AI to provide personalized financial advice, helping customers make informed borrowing decisions. Additionally, Danske Bank has implemented income-based lending caps, ensuring that borrowers do not take on more debt than they can afford while leveraging digital tools to continuously monitor customers’ financial health and proactively engage them when needed.

Lending affordability remains a critical issue in the Nordics, as regulators seek to balance financial stability, consumer protection, and economic growth. With rising debt levels and increasing pressure on households, regulatory frameworks will continue to evolve to ensure sustainable lending practices. As these changes unfold, lenders must prepare strategically by prioritising investments in technology that enhance data-driven decision-making and improve compliance with stricter regulations. Strengthening risk management systems will be essential for adapting to evolving market conditions, while a focus on consumer engagement through personalised, transparent lending experiences can help build trust and retention. By staying ahead of regulatory shifts and leveraging innovation, Nordic lenders can navigate this complex landscape and ensure long-term stability and growth.

By leveraging fintech innovations and AI, lenders in the Nordics have the opportunity to enhance affordability assessments and promote more responsible lending. However, they must also remain vigilant about the potential downsides of making borrowing too accessible. Balancing technological progress with responsible lending practices will be crucial in ensuring that consumers are protected and that lending remains sustainable in the face of rising debt.