BLOG

Finance Forward: 10 Breakthrough Innovations Reshaping The Future of Financial Services

Explore how cutting-edge tech will redefine the industry

The past twenty years have seen incredible advancements in technology of all sorts (do we even remember life before the smartphone?) – and the world of financial services is no exception. But innovation is far from over. The financial sector stands on the edge of even more cutting-edge technology, with increasingly sophisticated tech emerging that will enhance decisioning accuracy, improve operational efficiency, and ensure maximum customer satisfaction and engagement. What’s ahead for financial services providers? While it’s impossible to predict exactly what the next twenty years will look like, we’re looking forward to what may be in store in the near future, based on the tech innovations and market-shaping forces in play today.

1. Evolution in Ways to Pay, Borrow, Lend and More

There’s a variety of tech advancements on the horizon that could reshape how we pay for things, how we borrow money, and the landscape of financial services and products in general.

Some of these include:

Biometric Payments

Payments authenticated through biometric data including fingerprints, facial recognition, or retinal scans, enabling a seamless (and secure!) way to pay

Voice-activated Payments

Payments initiated through voice commands via smart speakers or other voice-enabled devices, greatly enhancing convenience for users

Invisible Payments

This includes transactions that occur automatically in the background (one level up from our automated payments for subscriptions for example), with IoT-enabled purchases that reduce friction

Peer-to-Peer (P2P) Lending

These lending platforms will continue to evolve, using blockchain for transparency and security

On-Demand Loans

Instant, micro-loans available on-demand via mobile apps, tailored to individual needs with flexible repayment terms

Tokenized Assets

Tokenization of real-life assets (i.e. real estate, art) enabling fractional ownership and lending, and providing investors with new opportunities

2. The AI and Machine Learning Revolution

Already integral to processing large datasets, ongoing advancements in artificial intelligence (AI) and machine learning (ML) are set to continue to redefine risk decisioning and the entire user experience. Future algorithms will leverage advanced neural networks and deep learning to enable near-real-time decision-making by not only analyzing complex variables (including behavioral patterns and unstructured data), but also predicting results with uncanny accuracy. These advancements in intelligence will also further enhance personalization possibilities, facilitating the shift from static to dynamic risk assessment and accommodating for life changes and real-time behavior – greatly increasing the inclusivity and fairness of financial services offerings (and the customer experience!) along the way. Advanced analytics will also help financial services providers understand on a more granular level how people are using products, enabling you to make improvements, track the customer journey, and interaction points. Likewise, AI enables us to break down silos across different datasets, understand consumer behavior much more dynamically across different systems – and allow you to tailor new products and services accordingly. The applications when it comes to financial services are endless, including AI-driven financial advisors that can provide highly personalized financial planning and wealth management services, tailored to individual goals and behaviors.

As we’re already witnessing, Generative AI will continue to have a massive impact. It is certainly making life easier in many ways (chat bots, personalized email and marketing campaigns, dynamic customer management, etc.), but it will also mean greater ease in testing products and models as new data sets are generated (which used to take an incredible amount of time when done manually). Generative AI could also help test different use cases for products and UAT testing (which is traditionally very difficult and time consuming). We can also use Generative AI to translate videos and documents in real-time, or even do live translations in meetings, increasing the serviceable markets of financial services providers who may have previously been limited by language or region.

AI in Banking market was worth $6794.27 million USD in 2023, and is expected to reach $36765.29 million USD by 2023 (CAGR of 32.5%)

3. Quantum Computing: The New Frontier

Quantum computing promises to fundamentally change the capacity to process information by performing calculations at speeds unattainable by traditional computers, enabling the ability to execute complex risk simulations and fraud decisioning and detection algorithms. This speed enables quicker, and more informed risk decisoning for financial services providers. Quantum algorithms could simulate market reactions to economic events or stress test financial portfolios under a variety of conditions, providing insights at a speed and scale that just isn’t possible with today’s computation methods.

4. Blockchain and Decentralized Finance (DeFI)

Offering a decentralized and secure platform that can transform traditional banking infrastructure, credit approvals, and monitoring systems, blockchain technology can make big waves in risk decisioning, with advancements in peer-to-peer lending, smart contracts, and fraud screening measures. With transparent and fixed record-keeping, the technology can streamline processes and reduce operational costs, automating credit decisioning and other transactional processes. And with blockhain’s inherent transparency, the reliability of financial data is improved, greatly enhancing fraud and identity management. When it comes to the increasingly important aspect of identity verification, blockchain can also be useful – enabling Self-Soverign Identity (SSI) and Decentralized Identifiers (DIDs). SSIs allow individuals to own and control their own digital identities, stored on a blockchain for maximum privacy and security, while DIDs use unique, blockchain-based identifiers that can be verified across different platforms without exposing personal data.

5. Rise of Central and Digital Bank Currencies

The potential adoption of digital currencies, including those issued by central banks (CBDCs) could dramatically alter the financial services landscape. Impacting how credit is managed and issued, these digital currencies offer new mechanisms for transparency and efficiency in financial transactions, with faster transaction times, reduced costs, and improved access to financial services, especially in underbanked/underserved communities. When it comes to risk decisioning, digital currencies can provide more streamlined and integrated data flows, enabling better tracking of financial behavior and transaction histories, ensuring more accurate risk assessments.

6. Integrating IoT into Banking

The integration of the Internet of Things (IoT) in banking could provide continuous data streams to credit risk models, offering real-time insights into a potential borrower’s financial activities and habits, and ensuring more dynamic (and accurate) credit risk decisioning and lower default rates. For instance, data from smart home devices could inform lenders about a customer’s energy consumption patterns, which might correlate with financial stability or risk levels. This level of integration can lead to even more personalized risk assessments, potentially improving credit access and inclusion while mitigating risks for lenders.

7. Cybersecurity: Staying Ahead of Threats

With increased reliance on digital technologies comes increased cybersecurity risks. Robust security measures are critical, and future developments will include predictive and proactive security strategies to safeguard against continuously evolving cyber threats. The financial services industry’s vulnerability continues to grow, requiring innovative tech for protection like AI-driven threat detection systems that can predict and neutralize threats before they do damage. Proactive cybersecurity will become a critical component of risk management, ensuring that both customer data and financial assets are adequately protected. Advanced cryptography can also help with data security, including zero-knowledge proofs (allowing users to prove identity without revealing personal info, greatly enhancing data privacy and security), and homomorphic encryption, which encrypts data in a way that allows computations to be performed without decrypting.

8. Sustainable and Social Impact Lending

Environmental and social governance (ESG) is a hot-button topic across industries, and can greatly affect financial services providers. Risk decisioning models will need to reflect the growing consumer and regulatory demand for responsible lending and banking practices, and could even influence the overall strategy of financial institutions towards more sustainable and socially responsible operations. With a rise in conscious consumerism and corporate responsibility driving the integration of ESG into financial decision making, lenders can use ESG scores alongside traditional metrics to assess credit and fraud risk. This approach aligns with global sustainability goals but also greatly appeals to a growing number of consumers (and investors) who place high value on organizations that prioritize ethical considerations in their operations.

9. The Impact of Regulatory and Ethical Developments

As technological capabilities expand, so does the scrutiny around their implications. AI and advanced data analytics in particular will require the need for robust regulatory frameworks to ensure these technologies are used ethically and responsibly – including data privacy, preventing bias in AI algorithms, and maintaining transparency and explainability in AI-driven decisions. Financial services providers will need to navigate a world where regulatory compliance is about much more than just following laws, but also about maintaining ethical standards and ensuring ongoing public trust, especially in decisions that affect individual creditworthiness and privacy.

10. Identity Verification

The most critical aspect of offering loans or any other financial service is determining who you are dealing with and what the risk is. The way we identified individuals and their potential risk two decades ago was monumentally different than where we are today, and in the future this process promises to be even more seamless – and all-encompassing. We can expect even more dynamic verification codes to reduce the risk of fraud, highly-accurate DNA-based identification, genetic markers to be added to biometric identification systems, and more inclusive/accessible verification solutions that adhere to yet-to-be-established global standards for digital identity. Also possible are multimodal biometrics, combining multiple identifiers including behavior (typing patterns, mouse movements, gait) to continuously verify identity in real-time. Likewise, we can use wearable devices like smart watches and fitness trackers, as well as smart environment interactions (connected devices including smart homes, cars and workplaces) to verify identity, potentially reducing friction in the process.

Future Innovation and The Customer Experience

Technology has always had the power to drive significant change in all aspects of society, and future tech advancements will continue to alter how financial institutions operate and interact with their customers. A common theme running through all of these innovations is the ability to personalize products and offerings, highlighting the extreme importance of the customer experience. A prime example of this is dynamic, responsive onboarding – where financial services providers are tailoring the onboarding experience to individual customers by matching data checks (including identity verification, AML, KYC, and more) to the event risk and the responses of the customer. Depending on the consumer’s answers in an application, the actual application itself will change dynamically – populating additional responses required or minimizing friction with fewer questions if lower risk is determined.

Today’s consumers will no longer stand for long wait times, inadequate customer service, and mass-marketed products. Instead, a competitive edge requires rapid response times, omnichannel offerings, customized products, and frictionless experiences – all enabled by automated, real-time decisioning.

But the concept of ‘decisioning’ itself will also evolve. Currently financial services providers utilize specific triggers that result in a decision being made, whether that’s from the end-consumer applying for a product, or from a provider proactively analyzing data and making a decision to offer a new product. But with the increased availability of data, extremely fast processing speeds, and the enhanced use of AI to analyze data and behaviors, decisioning will become much more fluid. Rather than trigger points causing a decision, are we in for a future where decisions around customers and products/services are just continuous? Seamless? Always happening? This too will result in more hyper-personalization and a customer-centric approach in all aspects of financial services.

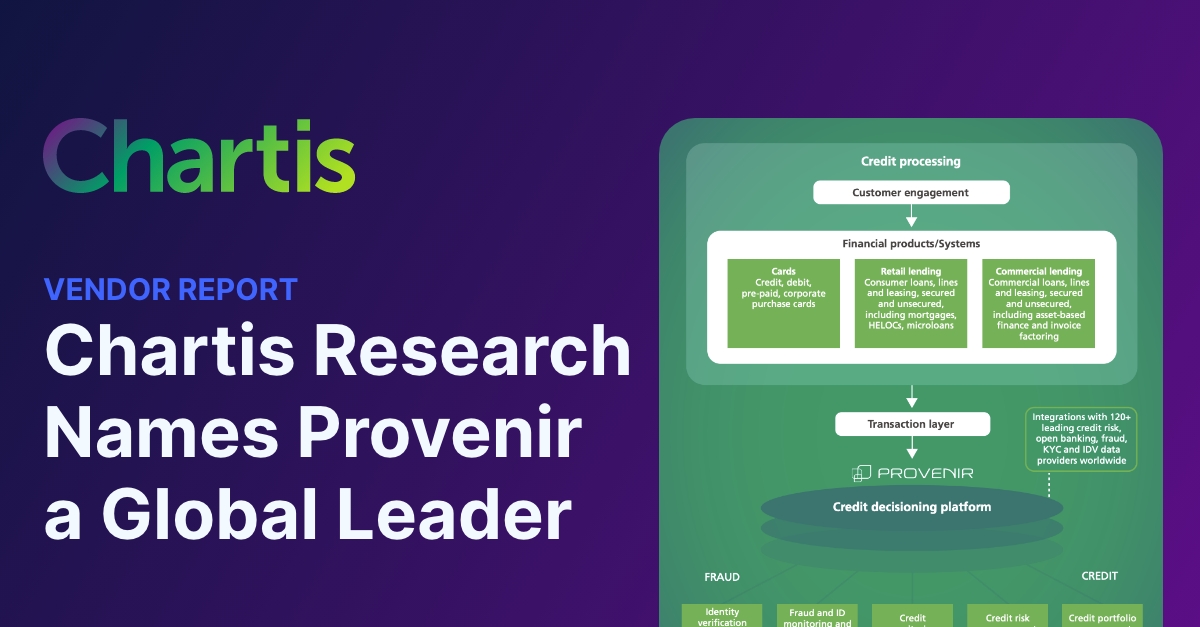

As these technologies develop, Provenir continues to lead the charge, offering an advanced decision intelligence platform that is adaptable, efficient, and strategically forward-thinking. Discover why choosing Provenir is the best decision for managing risk in a technologically evolving landscape.

Ready to lead in the future of financial services?

Contact us today to explore our cutting-edge risk decisioning solutions.

Contact Us

LATEST BLOGS

A solution needs to bridge the gap left by

The State of AI, Risk, and Fraud in Financial

Top Mortgage Lending Trends in the UK and Europe:

Thriving Through Change: Unlocking Success in Poland’s Lending Revolution

Shaping the Future of Decisioning: How These Leading Financial

Discover how telcos can enhance customer experience across the

BLOG Minimize Risk, Maximize Activations:Three Steps to Fighting Telco

The Growing Threat of Fraud in Auto Lending andHow